Interesting Niches – Simply Interests (Notes from March 30 to April 5, 2020) December 30, 2020

Posted by Anthony in Acquisitions, Automation, Blockchain, Coronavirus, Data Science, Digital, education, experience, finance, FinTech, Founders, global, Healthcare, marketing, questions, social, Strategy, Uncategorized, Venture.Tags: Data, Downturn, finance, Open Source, Package, Risk, SDLC, Services

add a comment

Nat Eliason, of Roam and productivity-type videos fame, mentioned that consistency has been the primary driver for his content rise. It’s refreshing to come across his newsletters as well as Tiago Forte and David Perrell’s for how varied their content is. Typically, we don’t have one specific idea we follow. It’s a collection of all of our readings and experiences. My collection has probably been more evident in this – especially if you pay attention to the notes – generally around startups but also finance, vc, sports, media. Plenty that interest me.

So, this is hopefully my last WordPress post on here and moving to Webflow to move my thoughts and musings for the recent time further.

In light of this, I am going to be doing something with lists. Specifically, around startups. But I’ve been obsessed with historical rankings / lists for a long while. Only now going to be putting the together (I lied – I’ve been piecing the together for a while). Hopefully it leads to explorations and transparency with connecting various lists around them. Be it industry, job hunt, maybe put some clarity to the lists that are typically without much detail. We’ll see! Look out for further info.

- Corona Investing (Meb Faber Podcast Part II, III)

- Staying rich and dealing with downtrends

- Cash / yield / gold all have drawdowns > 48%, so if you lose half of your money, does it matter?

- Mixture of trend following and yield can get drawdown to ~30%s

- 16min on the News

- Yaron Haviv, CTO of Iguazio & Mahesh (ML Ops Webinar 3/31/20)

- Develop and test locally and then turning it into production

- Package (dependencies, parameters, run scripts, build)

- Scale-out (load-balance, data partitions, model distribution, AutoML)

- Tune (parallelism, GPU support, Query tuning, caching)

- Instrument (monitoring, logging, versioning, security)

- Automate

- Streamlining collection of data, prepare at scale, accelerate training and deployment

- Why are ML Projects not deployed seamlessly? (Survey results)

- No starting with clear business obj – why are we doing this? Similarly, not a good business case

- Management failure including insufficient investment

- Poor communication or not having the right skills for the job

- Management resistance (“gut” and “real-world insight” over analytics and data)

- Selecting the wrong uses, especially in an overly ambitious project

- Data scientists asking the wrong questions due to lack of domain knowledge, primarily

- Disagree on enterprise strategy

- Big data silos

- Analytic Lifecycle – ML Eye

- Define business mission (eg – Reduce churn rate in cc usage by 15%)

- Project definition and resource evaluation (eg – Estimate propensity for cardholders to churn)

- Analytic solution design – translating objectives into data science tasks, workflow (eg design churn prediction solution)

- Capture and data preparation leading in to Algorithm Prototyping (eg prototype)

- ML Ops – key drivers for success for ML Platform

- Resource management (ability for multiple people to use multiple GPUs/machines running environment)

- Experiment management (ability to trace code, CL parameters, dataset for trained model – ability to keep track of result with envs)

- Capability to store models automatically, hyperparameter optimization (framework that helps search over optimal hyper param settings)

- Provision to store and manage ML datasets, models using tagging, automated versioning and querying capabilities

- ML Flows (drag and drop, visual tool to build pipelines), rapid experimentation, share & re-use

- Deployment

- Data science needs to quickly adapt

- What worked before won’t work now or in the future – concept drift

- Need for fast, iterative changes

- Synthetic data to create a basis for models in times of uncertainty – no time to deal with complexities in deployment

- Need to see business impact quickly

- Develop and test locally and then turning it into production

- Wade Arnold, Founder of Moov.io with Sam Maule MP of North America at 11:FS (11:FS FinTech 4/2/20 morning)

- Services consuming vs what we’re paying for

- Moov.io as free connection of services for banks using GitHub and pulling data from gov sites, for instance

- Project in Australia to update them

- For the big 3 core banking – they weren’t to be used on the internet originally

- He helped add an abstraction layer

- He wants fintech to be more of a d2c term than services and layers in banking

- In the past, using Microsoft SQL or Oracle – now, you wouldn’t want that

- All Open Source, especially internet and cloud providers enabling them

- Not much different than IBM adding mainframes before

- Open Source vs proprietary tech is scale

If you found this interesting, share with me and others:

Reflecting on the Year (Notes from March 23 to 29, 2020) December 17, 2020

Posted by Anthony in Automation, Blockchain, Digital, education, experience, finance, FinTech, Founders, global, Hiring, Leadership, Learning, marketing, social, Strategy, Streaming, Time, training, Uncategorized.Tags: AI, Business, Business Cards, Extension, investing, Platforms, remote, Startups

add a comment

When you just want to produce something for the day but you’ve been helping out others more than yourself, seek a site you use repeatedly for inspiration. Today’s Farnam Street and its post on quotes from AMAs 2020.

Shane Parrish, FS Founder – Jan 2020

I don’t want to optimize for work, and I don’t want to optimize for family time. I want to optimize for life. I get one life and I don’t want to look back at ninety yelling at myself because I regret doing or not doing something. I always try to keep that end in mind.

Anese Cavanaugh, IEP Method Founder – Feb 2020

Culture is the energy, the container, we create together to do our best work, show up as our best selves, be productive, and feel safe. It’s how we feel when we’re doing our work together.

Jeff Hunter, Talentism Founder – March 2020

All of us do work that matters. It may matter in a little way, it may matter in a big way. We’re surrounded by signals all the time that say some work is more valuable than others. But as I like to say, the person who cleans the bathroom and does that excellently is probably more valuable than somebody who’s the head of an organization and does it terribly.

Katherine Eban, Investigative Journalist – April 2020

As a journalist doing a book, it’s like a marriage; and I know this sounds a little cynical but,

marriages only get worse as they go along so you have to be really in love to start with. So, there’s got to be a real love there with the topic because the project and the reporting and the work is only going to get deeper and worse the further you get into the project. Start from a good strong place.

Marc Tarpenning, Tesla Co-Founder – July 2020

Long-term thinking is really this idea of always keeping as much optionality in the future as you can. Because you don’t know what the future is going to bring. So what you don’t want to do is constrain your future possible options because you’re on some trajectory.

Jesse Mecham, YNAB Founder – August 2020

Budgeting just means you’re deciding. We don’t want people spending less, we really want people spending without guilt. That approach of thinking you’re going to push through and restrict yourself just fits and starts. People do that again and again. Give yourself room to learn how you spend money and learn what you care about, and slowly as you work the four rules, you’ve found something sustainable.

Gretchen Rubin, Happiness Project Author – Sept 2020

People who have habits that work for them have a happier, healthier, more productive, more creative life. People whose habits don’t work for them have a lot more challenges. It’s a question of thinking more about how to make something [which makes you happier] into a habit.

Stefanie Johnson, Management Professor – Oct 2020

One of the amazing things about inclusion is that it’s really something that any of us can do. It’s not like you have to be a leader to make someone feel seen. Any of us can do that.

here

- Transform Your Data Science Projects with 5 Steps for Design Thinking (HumAIn Podcast 3/22/20)

- Data Collection – thorough data navigation skills

- Where is my data stored?

- How large is the data size?

- What quantity or quality do I need to launch?

- Who manages the data?

- When is it updated?

- Why is it relevant?

- Data Refinement – Large quantities of data are good, but high quality is better – invest in refining data

- Who has data insight or dictionaries/features?

- What data requires querying, feature engineering or preprocessing? By what techniques?

- When will the data be ready to move to next place?

- Where will it be stored?

- Why will it need to be refined?

- How can it be tested/validated for consistent performance?

- Data Expansion – With best data, problem may not be solvable. Integrations with APIs, feature enrichment.

- Who controls data access?

- What budget is available for obtaining more data?

- When do you stop expanding or iterating?

- Where can you get high quality data sources?

- Why are more data features needed?

- How do we decide what is most relevant?

- Data Learning – Models or features for insights for the product to accelerate the workflow

- Who determines the benchmarks for the model?

- What ML framework/algos are chosen for what you will predict?

- When do you decide that modeling results are ready?

- Where will you process the data locally or in cloud?

- Why does product/feature require ML?

- How much compute time or resources are available to model?

- Data Maintenance – Implementing into Production, while the data degrades over time

- Who is responsible for making changes to models with performance changes?

- What triggers/pipelines/data jobs implemented to monitor quality of data?

- If data falls below benchmarks, what do you action?

- Where do you commit time in schedule to monitor pipeline for qc?

- Why do your data modeling results decrease in quality in production?

- How do you communicate the results to PM, Data engineers, software engineers and in what frequency?

- Data Collection – thorough data navigation skills

- Remote Work and Our New Reality (a16z Podcast #529, 3/23/20)

- With GP Connie Chan for consumers, David Ulevitch for enterprise

- Scaling enterprise and infrastructure operations

- Prioritization, scaling and outages – platforms that are cut and pasted

- Legacy technology or video codecs make it tough to scale for the way you’re doing

- Tandem (watercooler), Zoom, Around the World

- More people to chat / participate in a virtual setting

- Recording and autodocumenting/archiving is easier than real world

- Online classes and verticals – v2 curriculum beyond streaming and animation, A/R or interactive ways

- Classes can fill up in the real world and now, with online settings, it can’t

- Krisp – background noise elimination or Muzzel – popup notifications off during screen sharing

- David is used to WebEx (from time at Cisco) for being always-on video conf

- More engaged for virtual

- Tandem will show you what you’re doing / what app – collaborate if shared google doc

- Gaming and entertainment – playing with friends, children and maintaining relationships like Roblox

- David installing an Xbox One even as a software dev moreso than gaming, but alone

- Asana / Workboard to align teams and communicating what’s important for org transparency

- Telehealth or telemedicine – more people going remote

- Remote work – myth for jobs that aren’t possible to successfully do remote

- Test case – most people aren’t comfortable video conferencing, but forced to

- Some like the separation of work and home life – people do want to work where they want and live otherwise

- What are the products/features – A/R or fashion show – save items for later when you overlay digital as a second screen

- Browser extensions or different destination websites

- Is it a horizontal or vertical platform that wins?

- Investing in the Time of Corona Part I (Meb Faber podcast #206, 3/20/20)

- Preseason training – running after practice to make it easier for games

- His firm has 45k+ investors and he’s heard from only a few of them

- Get rich – more money, and all relative

- 100k in net worth is Top 10% globally but 1M is top 1% globally – people want roughly twice as much

- Luck as out of our hands – marrying into wealth or winning the lottery, Ken Fisher had a chapter on marrying rich

- 88% of millionaires are self-made, other book said 80%+

- High-earning exec, upper level management, professionally as the path to wealth

- Morgan Housel as saying “I want to be a millionaire” is instead “I want to spend a million dollars”

- Timing – best (yearly, 17%) and worst (0.06% loss), market-cap weighted equities don’t work

- Small cap value and momentum is about 16% – drawdowns are inevitable in these types of strategies

- Portfolio manager hat for 20% returns – would look for concentrated tilts toward global value, momentum and trend following

- Lever up to 1.5-2x but the risk is there

- Small minority of companies with big winners – 100 baggers in investments

- Sizing in private investments – sidestep threats to money, which is you (eg AMZN 95% drawdown on way up)

- Money locked in – largest financial asset is house often – annuities are another

- Paul Merriman where he gifts annuities to his grandchildren and wraps in a trust

- Inconsistent opinion of illiquidity of house vs private

- Startup investing – QSBS treatment – investors can exclude 100% of cap gains ($10mln cap or 10x cost basis of stock)

- Investments into retirement accounts to gain – Thiel and Levchin doing this, along with Romney

- Opportunity zones in long-term, as well

- Angel List is one of his favorite, but there are others – own sweat or your labor or with others on behaving properly

- Manu Kumar, CEO of HiHello (20min VC 3/23/20)

- Founder at K9 Ventures, seed firm with investments in Carta, Lyft, Twilio, Auth0, LucidChart

- Founder of 3 prior cos, 3 with successful exits and then Carta

- Graduated in 2007, started his first company at 20, also

- Noticed gap in ecosystem and created a job he wanted to do with K9 and seed/pre-seed

- More capital being deployed and companies staying private longer, also

- Seed before was $500k and now multi million

- He’s a big fan of former operators starting venture funds but doesn’t have experience with many scouts

- Founders taking early money, especially with multi stage funds – harder for option vat

- Simpler answer for bigger firms – they’ve added new people, so what’s better than getting ball running with smaller checks

- Safe playground and training for the newer folks at the firm as they grow

- He believes this may phase out eventually

- At pre-seed, he has luxury to get to know teams before investing, especially since he does only 3-4 investments a year

- At later stages, there’s a concern for how quickly rounds are progressing

- His investment fund cycle is 5 years – 15-20 portfolio companies per fund (Fund I – 19, II – 14, III – 1/3 at 6)

- Check sizes have inched up marginally ($400-600k now but probably closer to $600k now)

- He has no FOMO in term sheet plays for chasing – he wants a mutual agreement on investments

- His LPs prefer concentrated portfolio, not diversification larger (Harry at 35-40)

- How do you avoid adverse selection – general issue at preseed funds (he and Tim Connors)

- For K9 – number of investments per year means he has a very tight filter – fit for investment thesis/model and mutual fit

- Making the call on people – diamond in the rough – help them seek the diamond

- How does he think about decision making as a solo GP? For LPs and fund itself?

- Benefit of being a solo founder from 1996 – dealt with it already and on his own – comfortable in making judgment call

- Leaps of faith – incomplete data

- 100% accountable / responsible on both ends

- Venture firms fall prey to group think – limit to where it’s healthy

- Group think and consensus is dangerous – most innovative companies are doing something unusual and different

- In 2009, for first investment out of K9 – he received a stock certificate and massive stack of papers

- Called GPs – hands to CFO and gives to safe deposit box – what’s he do? Became the kernel for Carta (never touch paper)

- Spent 3 years discussing this with teams before finally meeting Henry to pitch and pitch a second time

- Running HiHello has changed what he looks for in companies he invests in

- From before, no outsourcing or distributed or remote teams on his blog on K9 – recruiting has become a nightmare

- Remote belief was wrong for him – learn and adapt – now he is comfortable in advocating for remote

- As an investor, you aren’t at the cutting edge of products/technology – didn’t understand Slack until HiHello usage

- Get to experience new stack in starting a company – comm, hr, resources, tech, etc

- Fav book – How to Win Friends and Influence People by Dale Carnegie

- Best board member – different ones add value in number of ways

- What does he know now that he wished he had known before – Nothing

- If you know too much, it can be a deterrent. Being naïve may be a good thing – learn things at the right time.

- Worst thing for venture – mega funding rounds from multistage

- Best for venture – operators turning investors more often

- Workona as most recent investment – mostly working inside a web browser, building a desktop in the cloud

- Misha Esipov, founder & CEO of Nova Credit (20min VC 3/20/20)

- Using international credit history for application of cc, apt rental, loans and more

- Misha raised $69M and KP, Index, First Round, Pear and Core Innovation Capital

- Misha spent 5+ years in private equity at Apollo, I/B at Goldman

- Goldman established a rigor for being first-principle, arbitrage, structure and similar in natural resources

- Hunt for global raw materials (credit is unique pieces of data, formula for synthesizing and refine into pipelines)

- For value – business without a clear path to generating cash isn’t an enduring business

- Press and publicity can create the aura, but margin profile can contract and needs to thought out

- Grad school in valley and got into YC summer program and incredible access to the venture funds in the valley

- Authentic mission for what you’re doing and being honest – brings up the challenges and why they’re comfortable

- He wants to see more VC’s creating more value by helping execs to get to world-class and small portfolios

- He admired Matt Harris at Bain Capital – one of best fintech investors with a long-dated outlook across cycles

- Not an investor but has a curiosity for the space and decisions for data usage

- How do you manage the psychology of being a CEO? It’s his life’s work, so it’s hard to find a balance.

- David Bradford at Stanford Interpersonal Dynamics told him – at onboarding and 1:1, deliberately enter a contract with you

- If I’m micromanaging, you have a duty and obligation to call me out – I can’t scale as a CEO without that

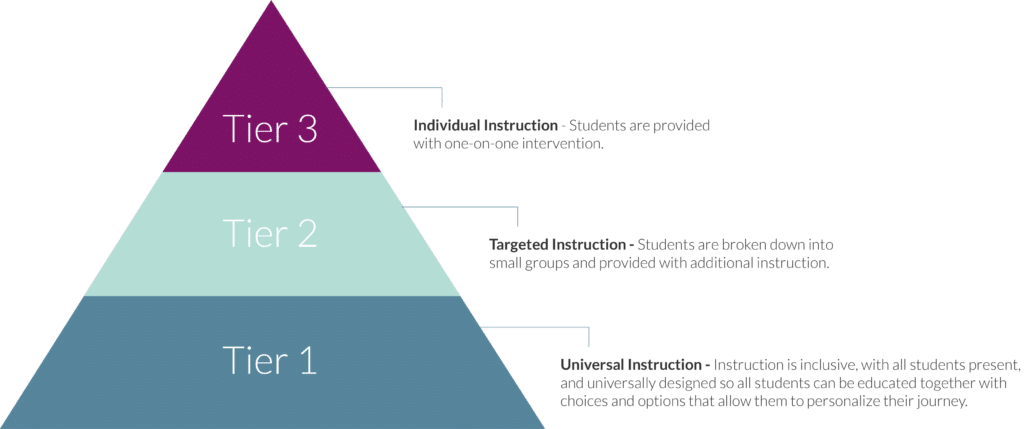

- If it’s not a tier 1, company-killing, decision, he lets the team decide and make mistakes

- Leadership team must signal some diversity to go down – 3 cofounders scaled to 10 (and all new 7 were male, by accident)

- Company example for future hiring managers for ensuring the proper candidates – reaching out to VCs

- Here is what I believe, look for and expect for you in a role – no misalignment in expectations

- Inevitably early on, it becomes on you to determine judgment for slipping on KPIs, individual may not be responsible

- Mastery by Robert Green – when he was debating on starting Nova or go back to finance world

- Purpose is to figure out the craft he wanted to master – financial engineering vs building org, team and pursuit

- Superpower in company building – attention, listening and spotting subtleties for following up

- Weakness – boundless potential on core business and pmf, wants to go into new thing but have to strengthen core

- Financial access for newcomers that are new/migrants to the states – strengthening this global infrastructure

If you found this interesting, share with me and others:

Transitioning Broader (Notes from March 16 to March 22, 2020) December 8, 2020

Posted by Anthony in Acquisitions, Automation, community, Digital, education, experience, finance, FinTech, Founders, global, Hiring, Leadership, Learning, marketing, social, storytelling, Strategy, Uncategorized, Venture.Tags: email, growth, investing, marketing, Operators, remote, Trends, VC, Venture

add a comment

I’ve been thinking of a transfer. WP pro? Off-site? Drive some different traffic, engagement.

But everywhere I look, it seems they focus on a very specific niche. Well, that’d bore me if I had to do multiple niches or pick a single to do first.

There’s a weird balance I can find between bouncing between options. Finance. Data. Products. Strategy. Read some startups here. Read funding notes here. Research there.

I think we’ll go with Webflow and try to let this be simple, easy and straightforward. Focus on the platform template and let them do the rest. Should speed up the site, also.

Why am I writing this and letting you know? Likely because I’m at an impasse personally and professionally. Got stuck professionally in consulting and contracting. When the work doesn’t seem like it can lead to further opportunities directly, we seek out others. How do we transition? What do we transition to?

I’ve overseen many projects in my time, some products, some features. If we’re looking for a broader sense – forest among the trees birds-eye view, maybe a few programs in my day. The designation wasn’t that in title, but it’s arguable. Finding the differences between product + project + program management has been interesting to read through literature in what I’d define as each. And even more interesting is going through the roles / titles in job opportunities among different companies. Loose definitions that encompass quite a bit.

I’m reading No Rules Rules. Co-writers Reed Hastings, CEO of Netflix, and Erin Meyer, author of Culture Map among others, dive into the transparency laid out at Netflix. Somewhat woven between stories and employee accounts is a framework for how to create this culture. It’s not for everyone, but it certainly entices to see how efficient an organization can be when employees feel emboldened and autonomous. It’s exciting, and leaves room to run. Processes and the chain of command are what hinder action so commonly throughout business. So far, the book is a fresh take on that. I’d consider checking it out! Otherwise, hope you enjoy the notes.

- Adena Hefets, Co-founder at Divvy Homes (20min VC 3/13/20)

- Early stage fintech investor at DFJ and original team at Square Capital

- Started Square Capital, the lending platform on their business – talented, dedicated group that was very successful internal

- multiB within Square itself, by now – thinking of what she wanted to do after

- Started in P/E at TPG, as well – they wanted her to go to business school initially, but felt weird doing that without doing anything

- Fintech – not as much innovation as she’d like to see – which industries that should be changing the most

- Inflection points in the market like housing

- Perspective as being everything – time as operator/ee at Square gave her insight to grow super fast

- As an investor, she saw the forest of overall landscape – as founder, takes a lot to scale company

- Believes she’d be a better investor now than before

- “Growth is challenging” – may need to think distribution channels or what it means to develop one

- Having a hard time prioritizing what product builds we have – to understand depth, have to see and work out a solution

- Here are the 5 Prioritizations and which allows me to go down 1 product build

- Unit economics – finance/p/e run by Jim Coulter and value-investing

- Company’s ability to cash flow and unit economics for product (make more than you spend on each user/customer)

- Level of deploying too much capital and trying to find optimal spend for seeking new customers

- $X to acquire the next customers (paid vs blended) – Divvy gets quite a bit of organic distribution channels

- 3 addictions for founder of a company – paid marketing, over hiring (most people want to build out a team right away), lower pricing

- Growing and successful company shouldn’t be indicated by how many employees – no hires and 10x revenue better

- Lower prices by 10-20% for incremental growth – careful in discipline for value of product and being worth your price

- She had an easy fundraise – her support prepared her very well and lucky

- Debt raising compared to equity raising is far harder for diligence – home tap

- Her investment bankers that she approached had no interest

- She is far more devoted to execution focused while her cofounder is culture, feeling and empathetic for the company

- Tough that people may expect females to be overly empathetic when she’s focused on customers and owning how/who you are

- Pushing people hard – don’t really have “yes people” – instead, “how have you thought about x, y, z?” and “does it deviate from what we’ve done?”

- TPG – inv committee would always have red tape – if you took exact opposite, how’s that look?

- Evicted by Matthew Desmond – challenges with rent & housing in US – don’t want to be at Divvy

- Persistence is strength – as a group, run through walls

- Weakness can be patience

- First check into Divvy was Max Levchin, incubated by HVF and Eric Wu at Nextdoor as a mentor

- Hard role to hire for – (In valley may be VP of Sales) but for her, COO role

- Jack of all trades – understand finance, marketing spend and other like HVAC in her business

- 100k homes in next 5 years for large amount of Americans (where the largest REIT is 80k)

- Early stage fintech investor at DFJ and original team at Square Capital

- Toni Shneider, Partner at True Ventures (20min VC 3/16/20)

- Portfolio of early-stage investments includes Peloton, Hashicorp, Fitbit, Automattic, Tray.io

- CEO of Automattic for 8 years helping WordPress get to top 10 global internet sites

- VP of Yahoo after acquisition of former CEO post at Oddpost

- Up and down on Sand Hill road for 1999 with Uplister and then Oddpost

- Phil and John had asked him if he was interested in venture as they were going out to new fund

- He said yes to both True Ventures and CEO of Automattic after being asked

- Founder friendly and coaching investors/VC’s instead of bosses

- Collaborative, where everyone is working closely, sharing credit/blame

- Being an investor and operator while at Automattic

- Helped that Automattic was distributed because he could respond to emails/texts/Slack

- True designed for partners to pursue deals, co’s in their own way – could multi-task

- Qualities of a great CEO and founder at companies – having seen wildly talented founders

- Driven, generous, creative and optimistic – sales wizards

- Love to focus deeply or obsessively (mentioned Blue Bottle Coffee – origin, experience of café, smell, prep and feel of cup – 10 years)

- Changing as investor – originally s/w eng, product mindset & overestimate product importance / idea

- He’s missed some deals, definitely

- Instagram pass very early before they pivoted there – sometimes the timing is off and that’s okay

- Focus on doing a great job for those that he makes a deal on

- Remote teams – where do people go wrong?

- If you work on something that can be done remotely – it should be a win because people can work how they want

- Fewer distractions with other stuff

- Centralized companies that don’t trust the remote model instead of going all-in from the get-go

- Salesperson that has to deal with geographies and sales should be in that area but you can have some centralized teams

- True had 3 very large exits – Ring (LA) to Amazon, Duo Security (NYC) to Cisco and Peleton (Ann Arbor) IPO – all built outside of SV

- Bay Area is fantastic but it’s possible outside of that – 25% SV, half in the US and another quarter outside of that

- Pros/cons of distributed

- Pros: access to global talent pool, happy employees

- Cons: how to build relationship/trust without an in-person connection, so far

- If remote, need to figure out a way to be together (Automattic is once or twice a year together)

- Favorite book – Their Eyes Were Watching, then Jim Collins’ Good to Great, also Predictably Irrational

- Time allocation for a portfolio – super responsive when they need him, half with existing portfolio and half for new

- Zero inbox person by end of week

- Biggest challenge at True Ventures – de-carbonization because it’s a completely new area and that it’s not a good place for VC

- Best board member so far – one for him was Ellen Pao from Project Include

- Most recently investment and why he said yes?

- PiaVita – med diagnostics platform for vets – impressed by founders – wanted to work with them

- Portfolio of early-stage investments includes Peloton, Hashicorp, Fitbit, Automattic, Tray.io

- Sam Parr, CEO of The Hustle (webinar on cold email 3/19)

- Crafting a message for cold email – AIDA

- A: Attention – interesting or curious – subject line and aligning the value add there

- I: Interest – interesting facts or use cases

- Hustle Con to CEO, for instance, interest that people at conf are avid learners and hustlers

- “Hate Salesforce” in reply to a tweet – hate the upload feature, for instance & you’ve an answer

- D: Desire – Show them how life/task is better with your product

- Do it by hand, sew dresses faster. X got a better

- A: Action – single specific action from this point – tell them what’s next. Signup or make a scale.

- Crafting a message for cold email – AIDA

I want to include how awesome The Hustle and their Facebook group Trends is. If you’re looking for ideas or new solutions to improve business/create a hell of a network or simply reach out to knowledgable people, it’s worth it. Yes, I posted an affiliate link – yes, it’s still worth its weight. Try it for $1.

If you found this interesting, share with me and others:

Better Foundations in Learning (Notes from March 9 – March 15, 2020) November 24, 2020

Posted by Anthony in community, Coronavirus, Digital, education, experience, Founders, global, Hiring, Leadership, Learning, marketing, NFL, questions, social, sports, storytelling, Time, training, Uncategorized.Tags: Author, Coaching, Coronavirus, Learning, marketing, NBA, NFL, NYT, Professor, Records, Teaching, Vulnerability

add a comment

Foundations. Linear effects. And continuous learning. How are they interrelated?

If you skip foundational learning because we’re too task-focused or hoping to land at an end result, you may luck into some 1:1 mapping of a linear effect. If successful, it may not even be a bad thing. After all, you completed your project / passed your test, whatever it may have been. However, that foundation that you may have missed out on (whether known or unknown) leaves something to be wanted. If the foundation is there, or often when you have the time to recognize the weakness and think systematically from there, you can make connections that surpass linear effects. Learning up from there doesn’t just climb a ladder, it adds others and helps you make connections that can be fruitful in further and further adjacent areas.

We see quite a bit of the ‘jack-of-all-trades’ or ‘generalist vs specialist’ conversations, especially in tech / data science. It’s hard to cover the depth if you start in a niche, unless you had or build a great foundation. Then it becomes easier to recognize opportunities that are similar to what you have done or learned previously. Cross referencing or adapting yourself to new language and key points that pretty much match. Then, knowledge over your foundation compounds and connections present new ideas in a better light. I’m sure this fails in some roles of various industries – but the deeper / broader your foundation is, the more likely you land on a similarity that can make it easier.

In this age of more information, it’s hard to sift through where to start foundation-wise. I think we could do a bit better on that front. I suppose this is somewhat the appeal of schooling – you get someone to hand you a syllabus and a guideline for what the frameworks are for some sort of foundation for a topic. Not up to you at that point, but it’s a block to start. After schooling, you hope that a job is a good starting point for giving you those basics while also creating your own style / fitting into processes. Rough to find yourself a machine in the cog where there’s little room for your own flare – blockers for expanding into other avenues.

What are the best ways to develop these foundations? Are there online curricula that demonstrate starter points or ones that people have found topic-specific? Each of us have our own style, so feel free to share – videos / courses / online / books / etc….

- Matt Mochary, Coach to VC’s and Founders (20min VC 3/9/20)

- Benchmark, Sequoia, Brex, Coinbase, Flexport, Plaid and others

- Investor at Spectrum Equity & cofounded Totality – sold to Verizon

- Growth equity fund in late 90s, heyday of growth internet – junior partner but couldn’t make a wave yet

- Founded Totality with a friend, raised $130mln and hired a ton of employees

- Academy Award shortlist for shortlist documentary and Doing Good for Mochary Foundation

- Came back to SV after having kids, best place to raise a family but didn’t want to start a company

- Wanted to become a coach, strategic thinking and coaching – students at Stanford were his first

- They recc’ed to friends that had graduated already

- Wanted to become a coach, strategic thinking and coaching – students at Stanford were his first

- Replaced fear with joy as the motivator

- Prefrontal cortex where creative thought occurs, amygdala is fear and anger – fight/flight

- In world of modern thoughts, recognizing fear/anger is being self-aware – he tells others to tell him if he has them

- If there isn’t urgency, he can wait – but otherwise, he tells someone else and has them decide

- When he has a group together – withholding neg thoughts is bad

- Think about it and once you have it, that’s powerful – if you don’t hear the thought process, you can’t fix it

- How to share difficult subjects that doesn’t trigger the counterparty – books “Difficult Conversations” or “Radical Candor”

- Timing of this has to be a good thing

- Having anger named and thoughts named “Hey, I sense that you’re feeling a lot of anger and I guess is that your thoughts are _”

- The person visibly relaxes but often less than what he says

- Imposter syndrome is fear – pick where you feel joy and take the things you don’t feel joy and remove them

- Energy audit, essentially – hour by hour (red/green markers)

- Could outsource tasks, stop doing them, or find out ways to be energy-raising for the things that need to get done

- Repeat the process in 30 days and then again in 60 days

- Energy audit, essentially – hour by hour (red/green markers)

- CEO role has to take care a lot of things – need to get done and get done well

- Cofounder example – extreme introvert and extrovert (half reports one, half reports other)

- Introvert loved internal meetings and extroverts loved external ones

- Cofounder example – extreme introvert and extrovert (half reports one, half reports other)

- Boards are the death of every great investor – if you sell to founders, you join their board forever – lots of time (4x year)

- 10, 15, 20 where 40-50% are board meetings and 20-30% with partners, other time for support of portfolio co’s

- Lose time to do what you really want to do – instead, ask “How can I be the most helpful to you?”

- You have a network and they need introductions, customers, recruits, etc

- 10, 15, 20 where 40-50% are board meetings and 20-30% with partners, other time for support of portfolio co’s

- Every single interaction he has – always asks for feedback “What did you like?” and “What was effective?”, brutal, possible

- Declares an action for recognition of the questions

- If feedback doesn’t resonate with you, don’t need to accept it

- Favorite book “High Output Management”

- He was a glutton for coaching, not seeing his family – really enjoys both but needs to find balance

- He gains energy from coaching vs the draining

- How does he feel about rising Chiefs of Staff – extension of yourself after automating and inbox zero but people still asking for more

- Training them is key – full access to your email/calendar and sitting beside you for every meeting/call for ~2 months

- Correlate and pattern match as you on your behalf – start with them and that gets your shit together

- If I don’t respect you, I won’t tell you about it – other will hate you for it – letting someone KNOW about being on time

- All companies should try to do Pledge 1% and act on it – feels SV doesn’t quite do its part

- Peter Feigin, Kevin Quealy, Graphics Editor at The Upshot and NYT (Wharton Moneyball 3/11/20)

- Propensity scoring for people matching on probability of using a shot – marathons and faster times with shoes

- Would love to randomize experiments for everything, but tough to do that with marathon winners

- How big an effect might a shoe matter?

- Regulations for heel heights are at 40mm but 38mm is where Alpha are (popular shoes)

- World records have kept coming down

- Why are early returns nonrepresentative – cities tend to report last

- Rule changes for NFL that they’ll vote on: sky booth ref, continue/restart a possession after scoring as 4th and 15

- With no crowds in NBA games, possibly to identify randomness of home/away splits

- Is it refs that end up being influenced or is it the crowd/home cooking, etc

- David Brooks, NYT author (KindredCast on WhartonXM)

- Was going through a tough time while a professor and told his class – they proceeded to let him know if he needed anything, they’d be available

- One of most powerful times of showing vulnerability and changing the design of the class thereafter

- Relationships on which are the most important – focus in class – Marriage, Vocation, etc

- Was going through a tough time while a professor and told his class – they proceeded to let him know if he needed anything, they’d be available

If you found this interesting, share with me and others:

Into Building/Growing? Check out these Communities (Notes from March 2 – March 8, 2020) November 2, 2020

Posted by Anthony in Acquisitions, Automation, community, Data Science, Digital, experience, finance, FinTech, Founders, global, Hiring, marketing, questions, social, Strategy, Time, Uncategorized.Tags: Building, ecommerce, finance, FinTech, Hiring, IndieHackers, low-code, Makerpad, No-code, SaaS, Strategy

add a comment

I think we can see a bit where we’re going as a society. Need some more community and less individual pieces. This has likely been exasperated by the current pandemic and the uncertainty of the approach taken to present a future. Thankfully, the internet does allow us connections from nearly any and all places, so for that, we can be grateful.

So, Trends would be if you want to learn from some excellent experts in the widest variety of industries. It’s for the curious, bold and excited. Ecommerce, SaaS, storage facilities, other real estate, business, professional services, whomever. There’s someone for every problem, ideas aplenty for solutions otherwise. Talk to a ton of people who just seek to do. This is all without even mentioning there’s a newsletter with a wide swath of input on the most prevalent (or soon to be) trends based on a heavy dose of research.

If that’s not enough, then whoever/wherever you are in your career, there are members that have volunteered to be mentors depending on what you’re seeking. Bounce ideas? They have that. Grow to $1mln, sure. Exit plans? Check. It’s the group to figure out what you think may be the next step. See it here: Trends link (yes, referral but I promise it’s worth it)

Next two revolve around code/no-code and building/hacking your way to product. IndieHackers, fairly split I’d guess between those that can code / develop and those that choose not to – as well Makerpad – a community of no/low-code people trying to replicate big scale/functionality with little effort. If you’re a student, especially, these are incredible – Makerpad‘s community/videos/walkthroughs are awesome value. Better if you’re a student, too. It should inspire you to start something – or at least see what it may look like.

IndieHackers – similar. Plenty of hustlers and side businesses there that you can interact with, as well as a podcast that is top notch, both for inspiration as well as knowledge/insights. See basic problems with solutions turn into full-blown businesses (Rent a Card Sign to Wedding Card printing, as two examples). The knowledge and people, from a straight global environment, is intoxicating. With the good kind.

Hopefully you’ll take these to heart and check them out. For now, these are the notes below. Some more experts, successes and adventures.

- Mark Goldberg, Partner at Index Ventures (20min VC 3/2/20)

- Dropbox, Revolut, Supercell, Plaid and Transferwise – all financial things

- BizOps at Dropbox, where company 10x’ed while he was there

- Went from 200-1500 people while he was managing there

- Was looking for a new thing, possible operator – talked to Index and some of other best ventures

- Importance of hiring / hypergrowth – 8 week interview process at time at DropBox

- 80% of time would be on hiring, not what he was looking forward to doing

- Highly commoditized as venture capital now – industry sees more money but offer is needed

- Evolution over last decade – Andreesen as services, others as sector expertise, data for a few

- Relationships as differentiator – connecting good investors, trust as foundation

- He was 30 years old in joining Index as an associate – flat hierarchy though, ton of autonomy and start investments

- Had been associate in a p/e firm 8+ years prior

- Find platform for the autonomy to increase your risk and search there

- Titles have become meaningless – true question: can you lead your round? Associates can at Index.

- To ask partner for looking for seed or traditional venture fund – are you going to dedicate the time to help get to next stage?

- If answer is no because it’s a rounding error, not worth it, likely. Earlier stage investments = more time, often.

- More angels joining – extremely risky and making money is hard

- Upside has limitations

- If he were to leave Index, he’d ask who are the smartest people to add to cap table – rolodex for increase business

- Historically, meeting the demand – all these great founders/operators on deeper side

- As an early board member – listen – don’t need a loud voice or overplay position as new member

- Being judicious about when to weigh in, praise, critique – impactful areas for you to dive in

- Favorite board member – getting to be in meetings with many at Index – Mike Volpi

- Offering hard conversations and messages to founders

- Lessons learned while passing or no – not focused, be direct

- Meet with an investor and then they get ghost you – try to close meetings

- Complement or help founders with an intro or interesting cases

- Thinks fintech is booming – not a bubble currently – trillion dollars in incumbents

- Just beginning to shift to the new crop – the 50th largest bank is $50bn in market cap

- Rise of Monzo and Revolut for UK / Europe – are they not going to just add student loans/mortgage/lending

- Best ones should, he thinks – Robinhood / Chime / New Bank (Brazil) – current account and then cross sell otherwise

- Favorite book – Barbarian Days by William Finnegan about surfing and surfing in SF

- Looks to see more climate tech investing

- Plaid selling to VISA – as a big win

- Enterprise software founders – “Have to get to $1mil ARR to get series A” – not true if it’s a solid business

- Data privacy company investment – new category of software to go after data privacy

- Dropbox, Revolut, Supercell, Plaid and Transferwise – all financial things

- Jeff Lawson, founder & CEO of Twilio (Invest Like the Best ep 158, 3/3/20)

- How to build a platform – cloud comms platform to customers like Twitch, Lyft and Yelp

- At his office – “Draw the Owl” – best values as needing to explain

- Call to action for builders – go figure it out – doing what you do as 2 step process of draw a few circles, then beautiful

- Early customers needed product (as API) opposed to the investor method which said it’s not a product

- Content center app, marketing – developers can take APIs that provide infrastructure to build an app at scale, quickly

- Twilio has virtualized the communications center much like AWS does computing and storage

- Stripe / Google Maps for similar functionality

- New era for enterprise software – initially, CIO made the buying decisions and things cost millions of dollars, years to implement

- On prem and expensive

- SaaS around turn of millennium could buy online and their heads could provision the services they needed

- For the scale and software – it’s a platform of things in their API

- Build or die compared to buy or build

- Incorporating software into business model – company would need new back-office financial

- Buy from vendor or build it – already built / reinvent but this would be solution after solution

- Banks with core competency for amazing software – digital banks

- In response, incumbents can do the same thing (one of Twilio’s is ING – few years ago promoted a new CEO)

- Becoming Agile, outside of devs, set of Agile teams – each part of small team

- Agile at ING video on YouTube – one of largest banks’ leadership in business saying they have to build to be successful

- In response, incumbents can do the same thing (one of Twilio’s is ING – few years ago promoted a new CEO)

- At AWS – customer intimacy to align by customer needs

- A product company with a solution makes a lot of assumptions for what their customers’ needs – may not intersect with differences

- A platform, however, can be utilized to build anything by customers – ING built a whole contact center on Twilio

- Lots of companies as on-prem for contact centers because the contact center market was broken – move to cloud

- Their billboard in SF that’s been there for 6+ years – “Ask Your Developer”

- Merging business with tech and developers but many companies just give them the tasks instead of the big business decisions

- How can we do that?

- Developers often enjoy doing the work over the weekend – Hack-a-thons over weekends or doing stuff then

- Finding what it means to be a part of your tribe – heroes, symbols and rituals

- Skip Potter – CTO of Nike, building unbreakable relationships with customers, being Agile, serving Nike

- ING story

- Nations / religions have many rituals – companies have rituals (say, bagels on Thursdays for all-hands)

- Wednesday night dinner at the offices – defining who they are, with a theme each week

- Symbols – what matters to the tribe – powerful thing you have are the values

- Culture: what you feel when you walk into work every day, whether articulated or not

- Can be good, can be bad during the interactions within the company

- Values: handles on the culture – allow for you to describe and guide the culture

- No shenanigans, foolish/nonsense – can’t just create/invent values

- Introspect the feeling when you walk in early – pooled 15 of people about 1/3 at the time to debate

- Be an owner

- Wear the customer shoes – customer-centricity

- Way you are customer-centric, looking at problem/company from perspective

- Go to a customer – I will trade you a Twilio-branded shoes for your shoes

- Culture: what you feel when you walk into work every day, whether articulated or not

- Kindest thing anyone’s done – Kevin O’Connor as founder of DoubleClick was an angel investor in one of his first company’s (dotcom era)

- Come to my Hampton’s house in the winter, bring a cofounder and figure out what you’re going to do, I’ll put in some money

- No plowing of roads – would order Amazon/UPS would plow the road for them – took about 9 months

- Invested in first company, and then believed in him as entrepreneurs

- Tomer London, Gusto co-founder (20min VC 2/28/20)

- Raised $520mln for Gusto, people platform for small businesses providing one place to run payroll, manage benefits, support

- General Catalyst, CapitalG, KP, T Rowe, Fidelity, and more – also angels Shopify founder Tobias Luttke, Sam Altman, Max Levchin,

Matt Mullenweg, Kevin Hartz and Elad Gil – did a PhD in EE at Stanford before founder/CEO at Vizmo (customer care for enterprise)

- General Catalyst, CapitalG, KP, T Rowe, Fidelity, and more – also angels Shopify founder Tobias Luttke, Sam Altman, Max Levchin,

- Originally from Israel, parents have a small clothing store in Hypha – started by picking up a VisualBasic book for the store at 11 yrs old

- Count inventory, sizing, and could do it via a computer with inventory management software – helped his dad, grandpa, cousins and friends

- 10 years ago, moved to the Bay Area to start his PhD at Stanford – met his cofounders Josh and Eddie – family history and connection to SMB

- Fundraising = creating change as a tool

- New channel to acquire customers that may be able to scale – $100mln ARR in 7 years, but maybe take 4 years with funding

- Might be making promises that can’t be fulfilled

- If you have a product, but you see an R&D opportunity for a new product to similar customer-set that may have a good opportunity

- Investors have a lot of time to talk about start-ups so they set the tone for “requirements” for seed/A/B/C

- Fin/VC Twitter and social media – he tries to be away and off of it

- Echo chamber may not enable the creativity of different thoughts

- Hard to have the mental space to think different/contrarily

- Gusto started in YC 2012 Winter – had good traction, knew people and were oversubscribed

- Josh came up with thinking about investors similarly to culture fit – values/motivation alignment sharing with Gusto

- Raised a $200mln round, working with 100k small businesses including dentists, lawyers, tech, barbershops and working

- Look for opportunities and purpose – less about being big but around specific R&D initiatives, scaling growth channels

- Try to make sure to bring people on the cap table that can add value – specifically, VP of Product Adam Nash at DropBox has been sounding board

- Be really picky about the people you bring on

- Delightful experience really matters

- Product / design reviews: product quality with function, ease of use, and delight (can’t add this later, has to be inherent)

- Delight is something of value and in a way that may be unexpected

- People come to them because someone has told the prospects that they love their payroll/benefits provider

- They don’t use the MVP, they use MLP (lovable product) – don’t waste time building things people won’t use

- Scoping down to test and ship it

- Product / design reviews: product quality with function, ease of use, and delight (can’t add this later, has to be inherent)

- How does it feel like to get paid? Maybe not anything at all – boring, just a check in the bank, missed opportunity

- Did a design sprint (a la Google Ventures) – short period of time/process for an email experience in payday – celebration

- When you meet someone for the first time – first 20-30 seconds really matter, personality shines

- If you understand personality of a product and brand, you can bring people in through copy/illustrations

- Raised $520mln for Gusto, people platform for small businesses providing one place to run payroll, manage benefits, support

- Justin Jackson, founder of Transistor.fm and Tyler Tringas, Earnest Capital founder (The Indie Hackers podcast #152, 3/6/20)

- Picking the right market to get started in that originated from Justin’s blog post called “The Main Thing”

- Justin was following curiosity – somewhat interesting after talking with Nathan Bashez – main thing swallows most value

- Eating out in college with limited $, he’d order entrée and water – most folks just do that

- Is that applicable to how we think of products? Can we frame it the way we build products?

- Josh was doing subscription forms for embedding in Medium posts – Medium increasing audience

- It was a nice-to-have to store

- Insightful posts for nice, concise wrappers around important things to consider

- Justin has a series and Tyler’s been the “reply guy”

- This is important to think about, and then what should we think about?

- Areas of disagreement are the implications for doing business outside of this – narrower (think: bootstrappers/indiehackers)

- Currently, Tyler believes indiehackers should be shying away from big things and verticals

- New twists on WP hosting, Todo app – not paying attention to 2nd order effects and incumbents

- Justin was following curiosity – somewhat interesting after talking with Nathan Bashez – main thing swallows most value

- Don’t build on top of other platforms vs building on top of others (Jason Cohen on an app store where someone else pulls you with)

- To get traction, need big ideas and concepts and then niche down by product or audience

- Distribution or differentiation – typically this is often in main spaces

- CRM, PM tool, ToDo, basic ecommerce, CMS hosting – chock full of stuff

- Tons of successful ones, lately (last 5 years), are apps – automated collections on Stripe, error collections on Rails, bolt-ons

- Distribution or differentiation – typically this is often in main spaces

- Developer market is one of most unique markets – things that work there may not work outside of it

- Devs have a larger #, avg revenue and highly incentivized to get better at what they do – maybe parallels with doctors

- Reachable online, congregates online and tons of opportunity to reach them

- Ecommerce first may share this, content-based, ad/news/blogs similarly compared to pure offline markets

- To get traction, need big ideas and concepts and then niche down by product or audience

- ConvertKit – state of union surveys between bloggers and creators – cognitive ceilings of bubbles after meet-ups and conferences

- Differences of WP plug-in, Shopify extensions for ecommerce entrepreneurs, etc – big market differences

- Characteristics of markets matter – pointing yourself in some direction to pull yourself, it matters what you’re first 1% is

- Differences of WP plug-in, Shopify extensions for ecommerce entrepreneurs, etc – big market differences

- Size of market does matter – leaning too far – have to quantify the demand for a product in a specific category

- Number of potential customers, new customers, average spend, frequency of purchase, growth rate, % reachable

- His market for Transistor.fm as moderate sized podcast hosting – say, 70k customers, potentially

- Tyler considering “side dishes” in the main verticals because of differentiation for your product and jump into distributions

- $10k MRR per founder may be the “default alive” amount but completely depends on what you’re doing

- Young Indie Hacker as total time without massive audience/trust can’t launch a direct competitor to Google Analytics

- Privacy-focused analytics as a trend, simple analytics, too – big audiences launch failed products all the time

- Experience matters, everything you bring to bare matters – Justin started blogging in 2008 – built the audience over time

- Reuben Gamez doesn’t care for audience – he knew SEO and had timing to help

- What trade-offs do you have to make for a market?

- Where are you in your life? Stage matters – spend some time on the slopes/get your experience

- Affiliates for Justin’s foot off the ground to succeed

- Nathan Berry – pattern in his life earlier than Justin – early 20s blogging and publishing then, selling early

- The practice and experience matters

- Main thing for niche audience or side thing for huge audience – questionable unfair advantages, main thing in huge market

- Pretty core product for them – “Crossfit gyms, for instance – Mind/Body went after yoga studios and everything for it as SaaS product”

- If you have a particular product insight into P/M or payment txns – try to match the niche product where insight is overvalued

- Pretty core product for them – “Crossfit gyms, for instance – Mind/Body went after yoga studios and everything for it as SaaS product”

- IndieHackers as afraid of competition they make this product that nobody really wants to pay for as Unique

- Justin brought up going to meetups in other cities/states to be the outsider and find out what they want

- Picking the right market to get started in that originated from Justin’s blog post called “The Main Thing”

- Gaming & Chrome OS / Steam, Going Cashless, Coronavirus Latest (a16z 16min on the News 3/8/20)

- Jonathan Lai and Andrew Chen from Consumer team, Alex Rampell from fintech team

- Steam – Valve corporation as the largest PC distributor of games after starting as Valve game

- Publishers controlled access to physical retail points – devs would take 20-30% of their games

- Developers actually made it 70% with Steam partnership – just took 30% otherwise, indie developers rise

- 30k games under Steam – not all would run on ChromeOS hardware, but can see smaller indies get access

- 90mn MAU, 1 bn registered accounts – social graph that may get ChromeOS more information

- K12 education – 60% of computers are Chromebooks now – Roblox, Stadia, Minecraft as possibilities for younger

- Google Stadia may unlock tiers of games for longer sit-down sessions because they wouldn’t be able to target all platforms

- Entertainment over long-term, new gameplay experiences – click to play alongside as an ad or video, social onboarding

- Going cashless – no employee theft, checkout line, armed trucks vs cash only (cc fees and tracking)

- Both sides of consumer cutting and for small businesses – rich people monetized at interest margin but others on fees

If you found this interesting, share with me and others:

What next? (Notes from Feb. 17 – Feb 23, 2020) September 25, 2020

Posted by Anthony in Acquisitions, Automation, Digital, experience, finance, Founders, Gaming, global, Hiring, marketing, questions, Real estate, social, storytelling, Uncategorized.Tags: Ads, Automation, experience, Founders, Gaming, global, Investors, Learning, Operators, Privacy, video

add a comment

So, we are into September of the pandemic year. Fires, hurricanes off the Gulf Coast, bubbliness of tech, political turmoil, and chaos in general driving the narratives. I know that it’s been a while since we last talked. Whirlwind of finding a new place (without seeing it in person), hiring movers, figuring out the best way to move, when to pack up from my place, when to pack up everything in the girlfriend’s, moving physically, purchasing new furniture, building and organizing has swallowed almost all of the time and sapped creative energy. Pile on to that that there were fires in southern California that had reached our new paradise, enveloping the sun. Suffice to say, we finally enjoyed a weekend (still very active, though) and now room to breathe this week brought me back to WordPress.

You know how many boxes there are in moving? I can completely relate to streamers or Dave Portnoy’s adventure. It’s rough. Covid seemed to jack up prices, as well, which seemed annoying. People that had moved double the size and similar distances were 30-50% less simply due to covid risks, I suppose? The misunderstanding of how contagious or how volatile the infection is clearly resulted in a few industries that got to take advantage in the name of “safety” (moving holds the same risk as it normally would unless you weren’t being cautious/careful in who you hired and brought onto jobs employee-wise). But hey, in options, you pay for the tail risks or you implode.

I still think drones or a body camera that projects out house / apartment layouts would be fantastic for realtors, buyers, sellers, websites related to the space. However, I’m more convinced now that moving companies could do a quick consultation of job requirements with them, designers could customize spaces with accurate measurements of space (blueprints / measurements of rooms don’t do justice to the nooks and crannies, as well as the ‘efficient’ space there may be with windows, shelves, etc). I know that various websites have independently done ‘customize your room’ with their products but if there’s an easy way to copy/paste urls or route APIs with image requests to an easily-replicable copy of your room (a la body-camera / drone), you may have an easier time selling across many products/offerings/sites.

Again, the drone technology continues to improve, so it’s possible we’ll have this or something from the phone to test out as image and object recognition improve. Could likely hack together something that did this. Attach a camera to one of those Costco drones that are $15 that are supposed to stay above ground upon simply detection of walls.

Anyhow, take a look at these awesome founders and investors that I listened to on various podcasts. The mix of serial entrepreneurs, big tech aspirations and side hustles was very fun to listen to.

- Ashton Kutcher, Founder & GP at Sound Ventures (20min VC 2/17/20)

- Portfolio including Lambda, Calm, Gitlab, Affirm, Bird and others

- Ashton’s wins include Spotify, Alibaba, Skype, Airbnb, Optimizely and Time’s 100 Most Influential

- Started at Univ of Iowa studying biochem engineering – power of a computer and learning to program

- Piqued his curiosity but he wanted to be an actor – started a production company at 25 (reality TV including Punkd, Beauty & Geek)

- AOL Chatrooms early on – marketing Dude, Sweet in various rooms – continuation in marketing movie

- Buffering speeds increasing – content would be digital

- He wanted to find companies that could quantify distribution of content and accelerate distribution of content

- Met Sarah Ross over at T/C, working for Mike Arrington – hired her to run his digital divison

- Introduce me to everyone that matters in the Valley (T/C 50), Jason Calacanis, Mike Cuban, Kevin Rose, etc…

- Asking all the questions – made his first investment into Optimizely (A/B testing platform)

- Met Sarah Ross over at T/C, working for Mike Arrington – hired her to run his digital divison

- Arianna Huffington as how does he introduce himself – as a father, first, apparently

- Future of internet are perpetually young, tech capability – learning and an ambition for new/useful/different

- Cutting edge of technology became his 3 teenage step-daughters so he mined them for ideas (as he was 35+)

- Major VCs and partners have a technical background, as entrepreneurs formerly or study to allow understanding of tech

- Toward companies with technical innovation and build company off of it – but isn’t their first lens

- Cultural narrative that may be important and valuable that you can build a product from

- Example – #metoo as here to stay or enduring – shift towards filling the void as rightful demand

- Looking at fertility space as trend for expansion

- Send a snapshot of the home screens for people’s phone on Twitter/Instagram and source ones he’s unaware of

- Toward companies with technical innovation and build company off of it – but isn’t their first lens

- Most brilliant people going to companies – which – did a survey with the founders

- Distance traveled by an individual – $1k to $1mil, a dime to $100k (as incredible)

- Growing up, he would probably say that his twin brother going through a heart transplant at age 12

- Going through a divorce of his parents that was tough

- Companies failed that didn’t feel good – not particularly rough since there are multiple

- Strong intuition in products not familiar – hard to get familiar

- Eating the dog food – before investing in Airbnb, he lived in them for 6 months

- Apple-ification of app ecosystem for UI/UX, enterprises getting smart also

- Consumers would use their enterprise software and to use the nomenclature would be better for their CTR

- Understanding what people want and simplify that – 3 things on a screen, where would you put the most important

- Spending time with founders mostly

- Ability to increase distribution funnel (his 5-10+ million Twitter followers), Spotify gave him an affiliate site with a discount code

- Largest music management side for partner, collective on branding and helping

- Versed on being in PR – public mistakes, apologize or utilize to get out of jams, crisis/preventative PR

- Product-sensibility, where you want to be – business, also – what does a company need to measure

- Which metrics matter, industry standards on metrics, how to improve them

- Portfolio manager from growth team on Stripe that works with them – narrative/storytelling

- Scaling angel to much larger institutional checks – Ron Conway was one of his earlier mentors, as well as Dan Rosensweig

- Cap table becomes your early board – value add outside of employees, low burn, grow team, disciplines

- The Undoing Project, Scale by Jeffrey West, Trillion Dollar Coach about Bill Campbell

- Misnomer about him – he’s cold (social animal, but super awkward)

- True happiness is being able to take your time

- Biggest challenge – Building a high quality team is hard with Sound Ventures

- Celebrity investing rise – lot of people are going to lose money, Wish he’d known: kindness doesn’t always come back around

- Recent investment with Sound Ventures that he’s excited by – Community (partner helped incubate) – luxury text messaging

- Portfolio including Lambda, Calm, Gitlab, Affirm, Bird and others

- Jude Gomila, Founder & CEO at Golden (20min VC 2/10/20)

- Self-constructing knowledge database built by AI and human-intelligence

- Raised from Founders Fund, a16z, SV Angel and others

- Also a successful angel in 150 companies including Carta, Airtable, Superhuman, Gusto, Linear and others

- Jude started Heyzap alongside the founder of Mercury, Immad

- Passions around tech, learning, universe working – physics in tech form (hardcore engineering) or abstract theorems (randomness/computability)

- Never wanted to work for someone – wanted to build things, but wasn’t aware of tech scene in London

- In uni, at 18, he wanted to start a company – formed a consultancy with a few friends

- Large Chinese manufacturer of egg packaging into Europe – wrote a plan to how they could do this

- They wanted them to run the business – he called every farm in the UK but they didn’t want to change

- Wanted to find something they could do themselves for a product that people would want with margin

- Digital photo frames – own brand into higher side of market – surprising

- April, had burnt through YC money and wanted to raise a round for Heyzap – 6 per day back to back

- Not impressive investors, go back on their word, converged on better investors instead

- USV pitched and they got the deal – Naval and USV for board – cool conversations on angel investing

- Mechanics on legal terms, contracts – part of something larger

- Put all of his money into angel investing in the next 7 years, advising as well

- Not impressive investors, go back on their word, converged on better investors instead

- Reality is out there, fairly objective – all follows similar rules, working together

- Ethics – both sides should have ethical framework/grounds – how to act during exit or bad situation

- One side making money, one on future – is it to top Roth IRA or something else?

- VC wants you to win the gold medal – that’s what is important because of model

- A personal best for you is better risk:reward, $20mln or 50 or 100 that’s fantastic, but not for VC

- Praying / spraying – he doesn’t like the praying part – more rational

- Numbers do matter, so spraying doesn’t fit this

- If there are nonlinear returns, you have to do 10-20+ investments (since network effects are nonlinear)

- Nonlinear market caps of monopoly or something like this are higher but capped at $1tn, likely

- Need to see different learning processes for various investments – has a lot of bullets and time

- Red/black flags for situations that you’ll always say no – yellow flags that you may be able to fix

- Markets and dynamics shift, but not human behavior – processes that identify these are very good

- Ability to get in to deals – how did he convince founders to take the money ahead of market?

- What companies need to exist? Knew that Paychex and ADP were terrible software, similar share, org charts broken

- Put it into a blog post of ideas that he wanted to see. Simple UI and great CX around payroll.

- Talked about culture of Gusto that wanted to exist and be unique. An hour of no business stuff, just the culture.

- Difficult to say whether you have confirmation or not – didn’t do well for a certain reason, can go again on the hypothesis (2-4 times)

- What companies need to exist? Knew that Paychex and ADP were terrible software, similar share, org charts broken

- Self-constructing knowledge database built by AI and human-intelligence

- David Sellinger, Founder of Deep Sentinel (OkDork w/ Noah Kagan, 2/14/20)

- Early Amazon work on ad-buying tech & first AI systems, directly with Bezos

- Started RedFin, real estate, as a side hustle (8pm – 4am)

- UX as the centerpiece, especially for investment deck:

- They wanted to build quick, interactive maps, simple straightforward

- He stumbled into Amazon after doing another ecommerce problem

- Google AdWords in 2001 – $0.50 per click for niche products with 50% conversion and 100-300% margin

- VP of Consumer wanted to go thru economics – $0.50 per click, $1 per conversion & repeated

- UX as the centerpiece, especially for investment deck:

- Bezos funded Deep Sentinel

- Provides 24/7 guards that monitor your home and best in market at a reasonable price

- He’s not in a place to solve climate change or global politics, but can build this safety of people in their homes

- Started RedFin, real estate, as a side hustle (8pm – 4am)

- Looks like Howie Mandel & he can pull it off fairly easily (but taller)

- Line between crazy and brilliant is quite blurred – Shawn Parker for Kagan

- Bigger visions? He has AppSumo where it’s like Amazon for software

- Big problems that are chosen – in-depth interviews (Shawn’s with Fortune) realizing the craziness, intellect, drive to problem selection

- Safety net for trying things worth trying because you get to rich, or super rich

- Day he launched RedFin (after year of working on it), was on the front page of Seattle Times in 2004, Imran Real Estate

- 400k visitors on first day – ISP called saying they don’t support porn sites (didn’t believe traffic numbers)

- Left Amazon 2 weeks after launching

- Believes that Amazon is a culture of Bezos – future holds more change than today, destroy the business today and go forward

- Senior executives to try out and do this – categories that don’t work, Fire Phone, Amazon Music or Photos

- David says he pays for Google Photos $150/yr – embodying the mantra

- One day in 2003-04, advertised Madonna book “Sex” and lost $100k Google Advertising Project but they weren’t looking for it

- Initially, Amazon didn’t run ads at first, for a while

- If you’re looking at Samsung TV, you’ll find a cheaper or different TV for conversion

- Had CATE algorithm (ML, Bayesian optimization) – stumbled on ad on website Code Red at Amazon credit card

- No matter what they showed before that, the most profitable thing to show the user was this ad

- Proved the ad was the way to do it – data backed it up (after saying it was terrible and they’d never do it as retailer)

- Had CATE algorithm (ML, Bayesian optimization) – stumbled on ad on website Code Red at Amazon credit card

- If you’re looking at Samsung TV, you’ll find a cheaper or different TV for conversion

- Balance is always a judgment call – willingness to re-litigate with any suggestion by new data

- Process of optimization vs innovation, Thomas S Koo by Structure of Scientific Revolutions book

- s-curve with normal science (optimization – some paradigm to optimize with evidence), build up that the model doesn’t work

- Early – matter was earth, water, fire and air before coming to atomic model

- What are the things that don’t fit into the model – the exceptions to figure out a rationalization

- s-curve with normal science (optimization – some paradigm to optimize with evidence), build up that the model doesn’t work

- Process of optimization vs innovation, Thomas S Koo by Structure of Scientific Revolutions book

- Senior executives to try out and do this – categories that don’t work, Fire Phone, Amazon Music or Photos

- Jeff giving advice to him while starting at Deep Sentinel, launching

- Design of the product, speed at which they move, and willing to experiment with the way they interact with customers

- Design award for being most aggressive camera – top part is LED light ring, battery-powered and was initially designed to not turn on

- Changed it so that the AI turns on the ring and spins – accidental launch after his team came to him saying it

- Camera will turn on red LED light on and say “we’re watching”

- Top of funnel for Deep Sentinel – cheeky top of funnel, but tech is done very well

- If you shoot someone, you’re the suspect, even if righteously

- Israeli security system, and he does contracts for background checks – (In California, has to do that) – uses HireSafe once he does that

- Mentioning that an Uber driver would be a security agent for a billionaire in the bay area – Noah asked him and it was $70k to sleep outside

- All the pieces but what would keep you from being larger?

- Markets can be very engrained and it’s a trick to get a customer to buy a different way

- Enterprise – wiggle your way into customer market and then switch it

- Nobody searching “cameras with someone that actually protects house” – should be this way, but not since people are used to others

- Redfin as them figuring out hook – address searches, neighborhoods and data for it – found the customers

- Have to take people buying burglar alarms and getting the market that they don’t work (99% false alarms)

- 15% of LA County budget is spent on false alarms – once people pass yard sign, it’s ineffective

- Markets can be very engrained and it’s a trick to get a customer to buy a different way

- After his neighbor got burglarized, he went through and called all the security companies

- ADT, Bay Alarm, Brinks, SimpliSafe, camera people, all standard questions – how does it prevent crime? How does it work? What do you do?

- Salesman for ADT at his home, what’s the new tech that PREVENTS crime? “The sensor was wireless.”

- Value was the slice of time in the interactions – AI changes the business process to make the human part efficient

- Average home needs 24/7 availability for ~700 seconds of security a day – when people are entering or exiting the property

- Intense decision for lifetime of relationships – pitched investors, got feedback